By Joice Alves

LONDON (Reuters) – Sterling fell to its lowest since mid-July against the dollar on Monday as surging energy costs and a summer of strikes highlighted the UK cost of living crisis and intensified fears for further economic slowdown.

Amid worries around Britain’s surging inflation and declining economy, sterling recorded its biggest weekly fall against the U.S. dollar since September 2020 on Friday.

By 1105 GMT, it was down 0.3% at $1.1798 after briefly falling to $1.1785, its lowest level since July 14.

Against a weakening euro, sterling held at 84.82 pence, edging 0.1% higher on the day, after falling to a near four-week low against the single currency on Aug. 19.

“The weak UK growth outlook continues to weigh on the pound. News that Ofgem is set to announce on Friday that UK average annual household energy bills are likely to rise to more than 3,500 pounds ($4,128.60) reinforces the headwinds facing consumers,” said Jane Foley, head of FX strategy at Rabobank in London.

Britain’s cap on domestic energy prices is expected to rise to over 4,200 pounds a year in January, up 230% on the year before, due to soaring wholesale costs and changes in the way the cap is set, analysts said in August.

Strikes over pay at Felixstowe, the UK’s largest container port, highlighted issues surrounding the cost of living crisis and threatens to worsen the supply chain issues for UK companies, Foley added.

SUMMER OF STRIKES

Felixstowe staff became the latest workers to strike in Britain as unions demand higher wages for members.

The squeeze on household incomes has already led to strikes by the likes of rail and bus workers demanding higher pay rises.

Money markets are pricing in another 50 basis point rate rise from the Bank of England next month as the central bank seeks to smother surging inflation at 10.1% in July. [IRPR]

An economist at U.S. bank Citi said on Monday British consumer price inflation is set to peak at 18% – nine times the BoE’s target – in early 2023. Benjamin Nabarro raised his forecast once again in the light of the latest jump in energy prices. Consumer price inflation was last above 18% in 1976.

In its August meeting, the BoE raised its benchmark interest rate to 1.75% from 1.25%, the sixth hike since late 2021 and the biggest in 27 years. It warned of a recession by the end of the year that could last until 2024.

Official data also showed Britain borrowed more than expected in July, underscoring the challenge facing the country’s next prime minister over how to provide more support to consumers.

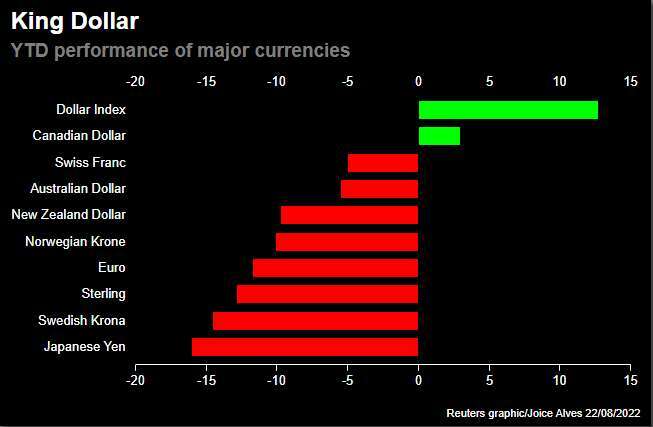

The pound has weakened more than 3% in August against a strengthening dollar, which has been supported by safe-haven flows. The UK currency is one of the worst performers among G10 currencies this year.

($1 = 0.8477 pounds)

(Reporting by Joice Alves; Editing by Mike Harrison)