Did COVID kill (the rise of) E-commerce?

By Manik Chopra, business analyst, Fischer Jordan and Param Kapoor, software developer, Fischer Jordan

“An in-depth look at the changes in shopping behaviour due to COVID-19 and how businesses can navigate this new landscape.”

Over the previous decade, the e-commerce industry has experienced exceptional growth, as evidenced not only by its escalating financial indicators but also by its profound transformational impact on everyday lives. This growth trajectory was notably catalysed in 2020, in response to the COVID-19 pandemic and the subsequent public health measures aimed at mitigating the virus’s spread. These extraordinary circumstances facilitated a surge in e-commerce usage across various sectors, with many presuming that this uptrend would endure throughout the pandemic years and beyond. Nevertheless, in this paper, we elucidate how, contrary to these anticipations, traditional brick-and-mortar retailers have been achieving higher growth rates than e-commerce platforms in the post-pandemic years.

The COVID-19 pandemic’s global sweep substantially influenced multiple industries, instigating a significant ascension in e-commerce, which, in turn, led to remarkable shifts in online shopping behaviours. Unlike preceding economic downturns, chiefly originating from financial market fluctuations, the COVID-19 pandemic was distinct both in its genesis and its resultant ramifications. The crisis instigated broad-ranging alterations in consumer behaviour, inducing individuals to abstain from activities such as dining out, travelling, and general outdoor socialising. Consequently, even those in employment curtailed their expenditures, inducing a substantial boost in personal savings rates throughout the pandemic.

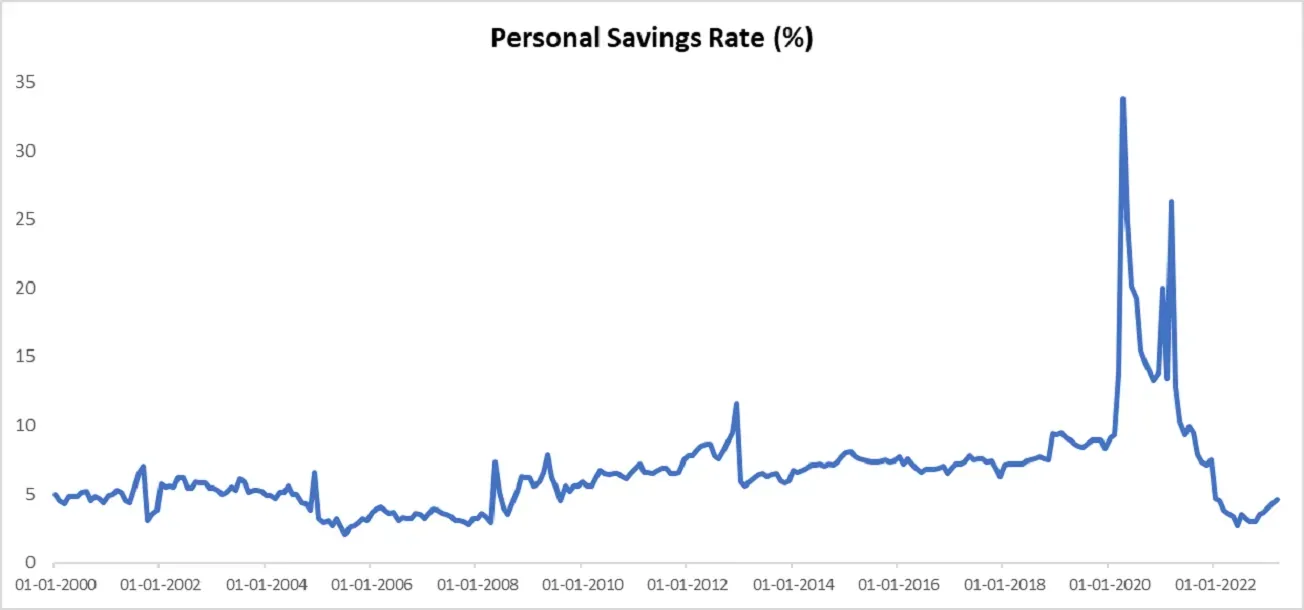

These extraordinary circumstances yielded a fascinating context for examining the dynamics between demand and accessibility in the traditional retail sector versus the e-commerce industry. Government-imposed safety measures, including global lockdowns, significantly limited access to physical retail outlets, thus inadvertently promoting e-commerce as the primary consumer shopping venue. Despite exhibiting certain recession-like characteristics, such as diminished consumer spending, the COVID-19 pandemic did not fully mimic a conventional recessionary pattern. Anomalous increases in personal savings rates, stimulated by government interventions like the Coronavirus Aid, Relief, and Economic Security (CARES) Act, furnished consumers with disposable income, further reinforcing the advantages e-commerce platforms leveraged during the pandemic period. [1]

Figure 1: Personal Savings Rate

(U.S. households accumulated about $2.3 trillion in savings in 2020 and through the summer of 2021, above and beyond what they would have saved if income and spending components had grown at recent, pre-pandemic trends. In 2021 households decumulated about one-quarter of these excess savings, as the saving rate dropped even below its pre-pandemic trend) [2]

Projection-Based Analysis: E-commerce and Offline Retail

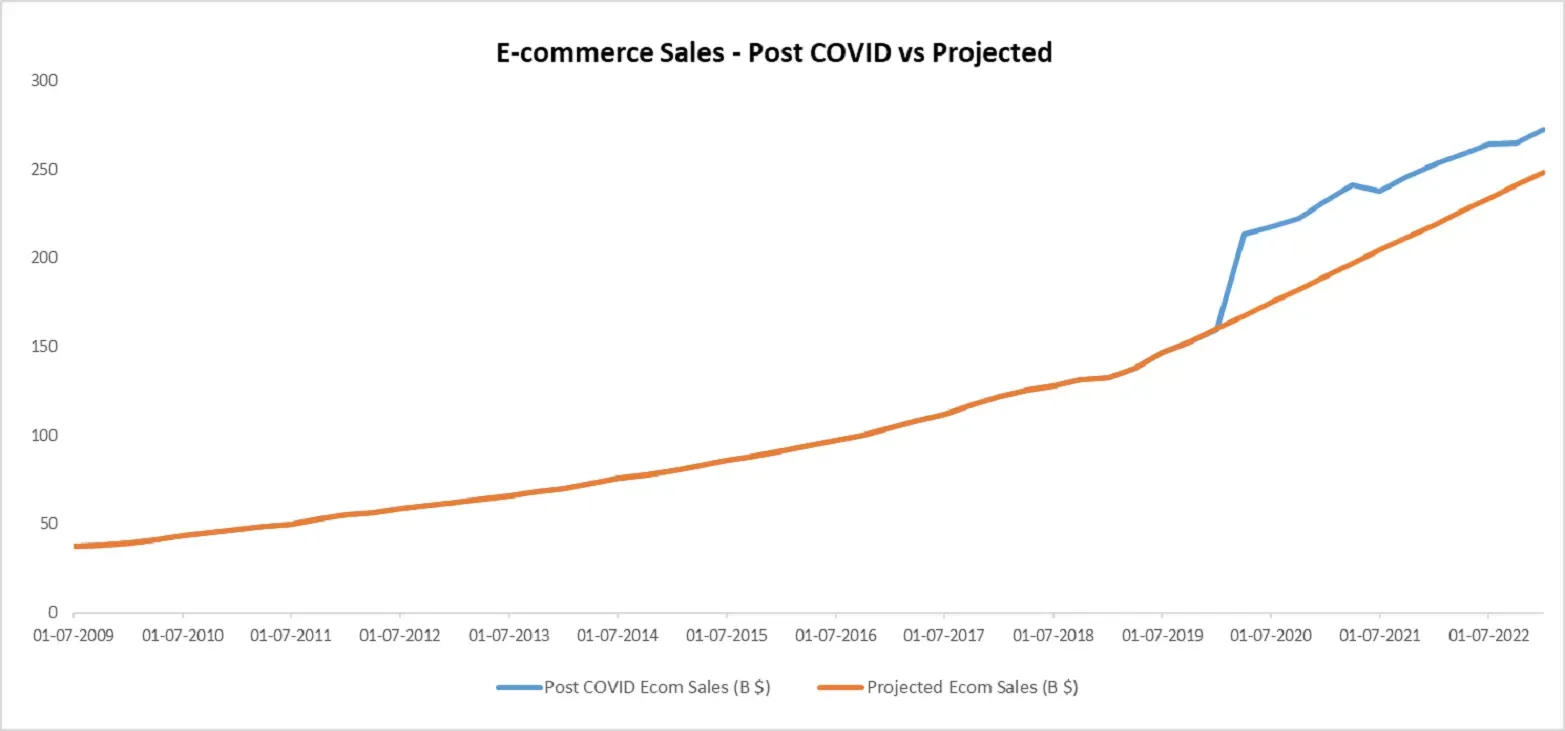

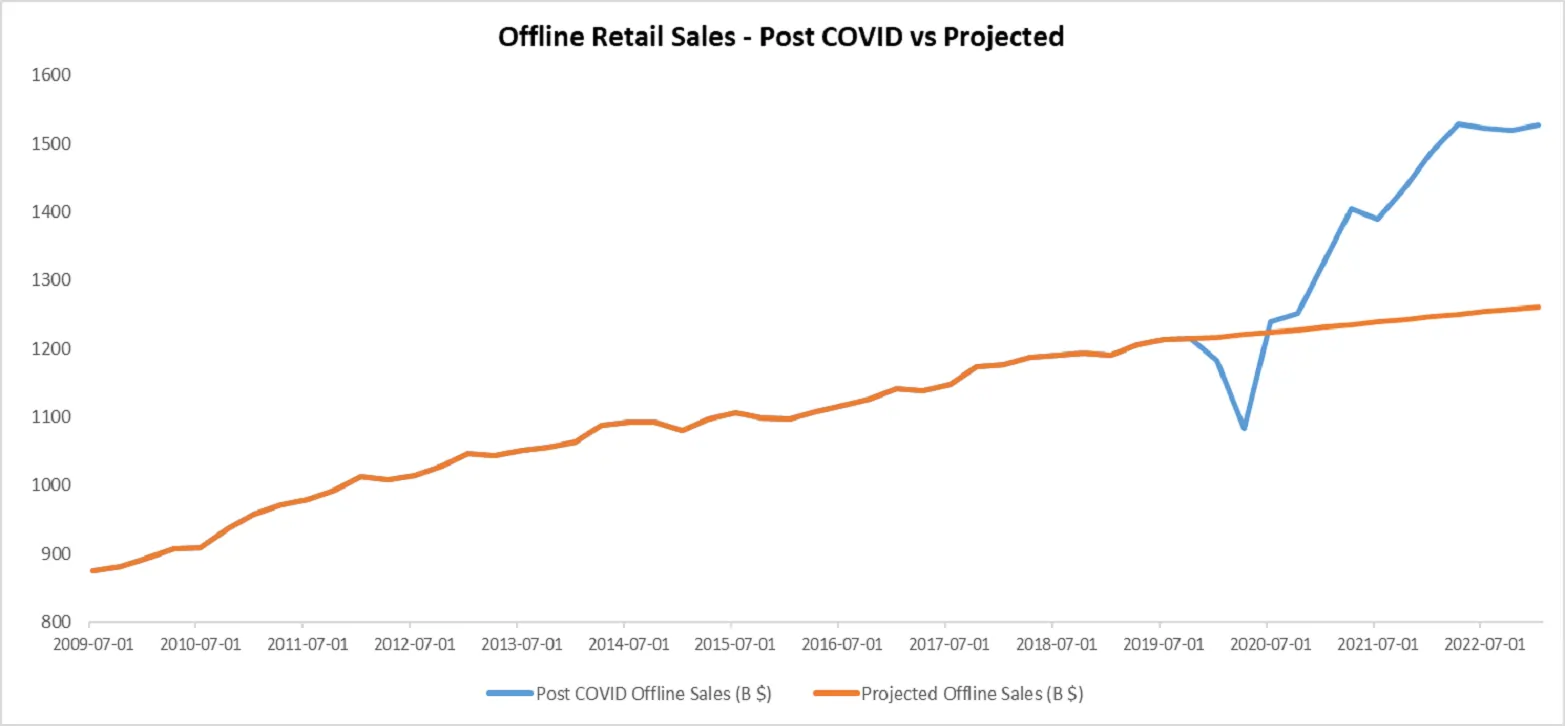

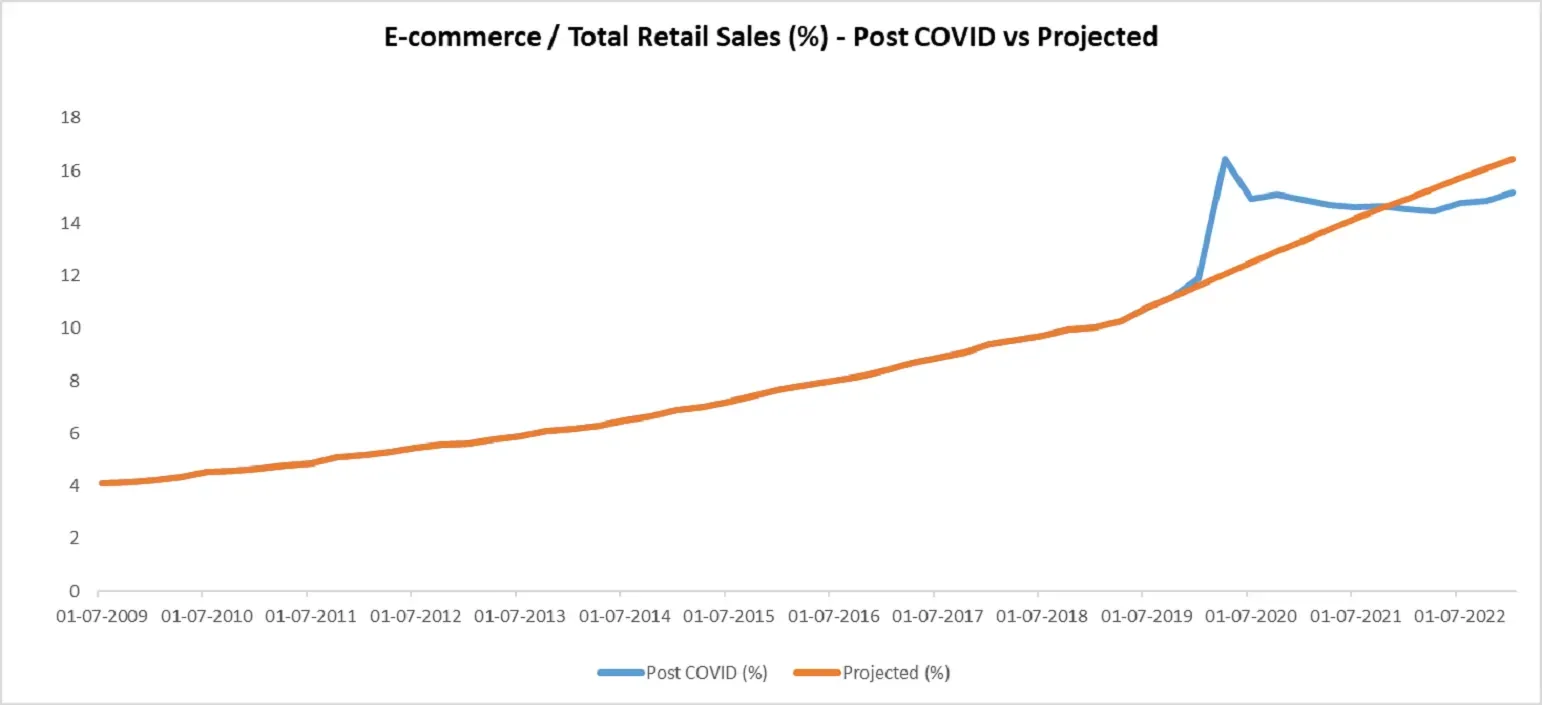

To better understand the effects of the COVID-19 pandemic on both e-commerce and offline retail, we compared the post-pandemic sales of both channels to the projected sales based on pre-pandemic trends [Annexure A].

Despite the apparent advantages discussed above, analysing the data of offline retail growth versus e-commerce growth approximately two years after the pandemic reveals a picture that does not align with the expected outcomes. While e-commerce experienced a surge in numbers during lockdown periods and peak-pandemic years, it quickly returned to pre-pandemic growth rates. Interestingly, offline retail, on the other hand, has demonstrated more sustained growth post-pandemic.

The graphs below, depicting real data and projected data of retail and e-commerce growth during the pandemic clearly illustrate this disparity.

Figure 2: E-commerce Sales – Post COVID vs. Projected [3]

Figure 3: Offline Retail Sales – Post COVID vs. Projected [3]

Figure 4: E-commerce as a percentage of Total Retail Sales – Post COVID vs. Projected [3]

Although e-commerce has grown post the pandemic, it lost to offline retail in retaining its market share in the retail space. From the above we can see that e-commerce is only 8.5% higher than the projected trajectory, while offline retail is 17% higher than its projected trajectory. Overall, e-commerce as a percentage of total retail is lower than its projections as well.

The story of these numbers depict how offline retail outperforms previous trends and e-commerce numbers post-pandemic while e-commerce seems to be returning to normal growth patterns even with clear-cut advantages during the pandemic that should have caused sustainable growth for the sector.

Sector-Based Analysis

An examination of sales data on a sector-by-sector basis uncovers a persistent trend across all industry divisions. Notably, post-pandemic sales for brick-and-mortar retailers surpassed the anticipated trajectories predicated on pre-pandemic trends. Annexure B enumerates several sectors that underscore this prevailing trend. This overall consistency bolsters the idea that the observed post-pandemic growth in offline retail was not an outcome of isolated performance in specific sectors, such as high-value commodities like automobiles and luxury goods. Instead, it implies a broader consumer shift favouring traditional retail outlets over e-commerce platforms and other purchasing channels.

Furthermore, a closer examination of specific retail industries reveals that several sectors have surpassed their pre-COVID growth rates. Industries such as automobile and motor vehicle dealers, furniture and home furnishings stores, building materials and garden equipment and supplies dealers, food and beverage stores, grocery stores, health and personal care stores, sporting goods, hobby, musical instrument, and book stores, as well as non-store retailers, have all demonstrated exceptional growth post-pandemic. This data suggests that consumers have reinforced their preference for offline retail experiences, indicating that e-commerce has not been able to make significant inroads in capturing market share in these verticals, despite the advantages it gained during the pandemic.

Comparison of e-commerce and offline retail stock prices

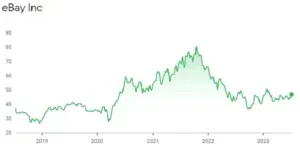

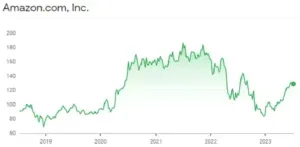

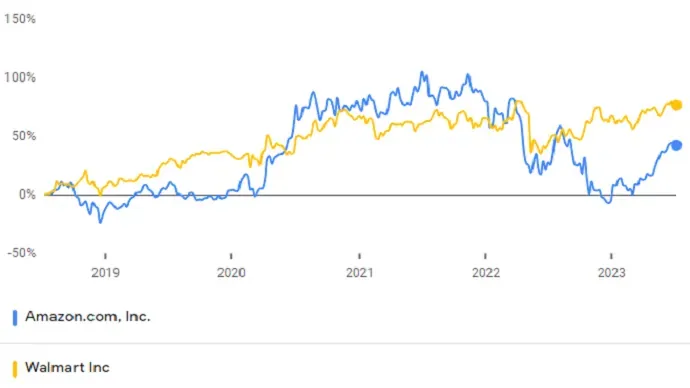

The trends observed in e-commerce players’ stock prices further corroborate these findings. Although there was an uptick in stock prices during the pandemic years, the subsequent period indicates a failure of the e-commerce industry to fully capitalise on its advantages, leading to a shift in consumer preference towards offline retail. The stock charts below help visualise the trend.

| Figure 5: eBay Stock Price – 5 Years | Figure 6: Amazon Stock Price – 5 Years |

Figure 7: Amazon vs. Walmart Stock Prices – 5 Years

Deep Dive: What prompted Consumer Shift back to Offline Retail?

To understand why e-commerce has underperformed relative to brick-and-mortar retail in the post-pandemic era, taking a closer look at the factors that have spurred e-commerce growth over the past decade lends itself to interesting insights. E-commerce has significantly flourished in the past two decades by offering lower prices, greater product availability and selection, and heightened convenience to consumers discontented with the mundane and costly alternatives in proximate stores and shopping malls.

Let us delve deeper into each of these influential factors and their role in moulding the retail landscape, both pre and post-pandemic.

Lower Prices

E-commerce platforms initially offered lower prices than physical stores, attracting price-sensitive customers with considerable discounts and frequent sales events. As brick-and-mortar stores recognized the burgeoning competition from e-commerce, they responded by offering competitive pricing to retain their clientele. A recent study conducted by Harvard Business School professors suggests that pricing in online and offline retail channels is indistinguishable approximately 69% of the time, thereby mitigating the price advantage e-commerce once held. [4]

Moreover, the COVID-19 pandemic and the governmental measures introduced in its wake, including the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) and the Paycheck Protection Program (PPP), drastically altered the nation’s financial landscape. The resultant inflation, spurred by the substantial increase in consumer spending power, diminished consumers’ price sensitivity. Consequently, e-commerce no longer enjoys a distinct edge over offline retail in terms of pricing.

Greater Availability and Selection

E-commerce opened up the global marketplace to the everyday consumer, offering access to a vast array of products from around the world, right at their fingertips. This plentiful product selection contributed significantly to the rise of e-commerce over the past decade.

Historically, minimal overlap existed between online and offline retail channels. Still, technological advancements spurred innovative business models among brick-and-mortar retailers to attract customers. Online-to-Offline (O2O) commerce, a strategy that leverages online marketing to drive in-store traffic, has seen exponential growth. Enhanced use of consumer insights and analytics enables offline retailers to offer more relevant stock keeping units (SKUs) to their local customer base. In some instances, trending products like the PS5 or Apple Vision have been more readily available at local stores than online platforms. [5]

As brick-and-mortar retailers increasingly adopt technological advancements, product availability and selection cease to be significant differentiators between online and offline retail.

Convenience

E-commerce initially capitalised on the ability to offer an extensive range of products to consumers within the comfort of their homes. However, the COVID-19 pandemic and ensuing home confinement dramatically affected traditional retailers’ sales.

This crisis necessitated a rapid digital transformation in the brick-and-mortar retail industry to align with changing consumer preferences. With in-person shopping restrictions in place, offline retailers adapted strategies such as Buy Online, Pickup in Store (BOPIS), curbside pickup, and home delivery. These practices, widely adopted and well-received by consumers across the country, continue to be offered post-pandemic. [6]

Brick-and-mortar stores now provide customers with the best of both worlds. Consumers can place orders from home and choose either to visit the store to try products or opt for delivery. By offering these services, offline retailers have managed to trump e-commerce in its own realm of convenience, providing customers with a broader range of shopping options at their convenience.

What Unique Attributes Does Offline Retail Bring to the Table?

Shopping isn’t just about buying products for customers, it is an experience and selecting and placing an order for a product is just a small part of it. And this is where e-commerce really lags behind brick and mortar stores.

In-person shopping provides a unique emotional and social experience to each customer that just can’t be replicated by e-commerce. Brick and mortar stores offer customers the ability to see, feel and try products before purchasing, this implicitly creates a higher level of trust in the mind of the customer which translates into easier purchase decisions. Customers also don’t have to wait for days before receiving their products, leading to instant gratification.

Customers get to interact with the brands that they love and get feedback from them at the same time, this happens in-store in the form of sales-people interacting with customers and helping them through their shopping journey. Moreover, shopping is more often than not, a social activity, where people go to malls and stores with their friends and family and interact with each other while buying products that they all like.

The Road Ahead: Navigating the Future of E-commerce

In summary, the COVID-19 pandemic transformed the global retail landscape, facilitating a sudden surge in e-commerce usage due to enforced safety measures. Nonetheless, in the subsequent years, offline retail has demonstrated a surprising resilience, consistently outpacing e-commerce in terms of growth rate. The unique experiential and social attributes of brick-and-mortar retail have contributed significantly to this resurgence, emphasising the value of tangible product interaction and immediate gratification in the consumer shopping journey.

Given these trends, what strategies should e-commerce platforms employ to regain their previously robust growth rates? The future of e-commerce lies in innovation and creating immersive digital shopping experiences, nurturing direct relationships with consumers, and leveraging social media as an integrated shopping platform.

With advancements in technology such as the Metaverse, augmented reality (AR), and virtual reality (VR), there are myriad opportunities to augment the online shopping experience. By creating immersive, virtual shopping environments, e-commerce can offer a more tangible and interactive experience that closely mirrors the in-store shopping journey. Implementing these technologies could bridge the gap between the physical and digital retail worlds, potentially attracting consumers who value the tactile aspects of offline shopping.

Another interesting development is pivoting to a more direct-to-consumer (D2C) model that can foster stronger connections between brands and consumers. Over the past few years, the D2C space has witnessed substantial growth, with consumers demonstrating a preference for brands with which they share a direct, personalised relationship. For example, between March 2020 and January 2022 online stores on Shopify grew 201.53%. [7] By cutting out intermediaries, brands can provide more bespoke experiences, thereby building loyalty and boosting customer retention. This approach, combined with greater use of data analytics for personalised marketing and product offerings, can significantly enhance the e-commerce experience.

Additionally, leveraging social media as a shopping channel offers another powerful strategy for enhancing customer engagement and retention. As social platforms become increasingly integrated into people’s daily lives, they provide an accessible touchpoint for brands to reach consumers. Social commerce – the integration of shopping experiences directly into social media platforms – is an emerging trend that has potential for strong growth in the coming years.

Finally, e-commerce platforms could explore opportunities for collaborative partnerships with offline retailers, providing a blend of online convenience with offline product interaction and immediacy. Hybrid models such as ‘click-and-collect’ have already gained popularity, and further innovation in this space could lead to more seamless integration between online and offline retail experiences.

In conclusion, while the landscape has evolved, there remains significant scope for e-commerce growth. By focusing on enhancing digital shopping experiences, nurturing direct consumer relationships, and leveraging social media and hybrid shopping models, e-commerce can position itself for a strong future in the ever-evolving retail sector.

Annexure A:

Projections were made using an exponential smoothing method. Quarterly sales data from July, 2009 to December, 2019 was used to project future sales.

Annexure B:

Projections were made using an exponential smoothing method. Monthly sales data from January, 2010 to December, 2019 was used to project future sales.

Link – Sector-wise analysis. [3]

References:

- Irwin, Neil. “How America’s Pandemic Economic Response Fought the Last War.” The New York Times, 15 Nov. 2021, https://www.nytimes.com/2021/11/15/upshot/pandemic-economic-response.html

- Aladangady, Aditya. Excess Savings During the COVID-19 Pandemic. 21 Oct. 2022, www.federalreserve.gov/econres/notes/feds-notes/excess-savings-during-the-covid-19-pandemic-20221021.html.

- US Census Bureau. Monthly Retail Trade – Main Page. 15 Apr. 2019, https://www.census.gov/retail/index.html

- Cavallo, Alberto. “Are Online and Offline Prices Similar? Evidence From Large Multi-Channel Retailers.” The American Economic Review, vol. 107, no. 1, American Economic Association, Jan. 2017, pp. 283–303, doi:10.1257/aer.20160542.

- “O2O Commerce: Online-to-Offline Retail Is Growing.” BigCommerce, www.bigcommerce.com/ecommerce-answers/o2o-commerce.

- Longfield, Nicola. “The Rise of Direct-to-Consumer.” KPMG, kpmg.com/xx/en/home/insights/2022/10/the-rise-of-direct-to-consumer.html#:~:text=With%20customers%20and%20manufacturers%20now,than%2016%20percent%20in%202021. Accessed 2 July 2023.