By Anisha Sircar and Shreyashi Sanyal

(Reuters) – European stocks rose 2% on Friday, clocking gains for the first time in six days after key U.S. jobs data eased bets of a more aggressive Federal Reserve, but logged their third straight week of falls on concerns over a spike in energy prices.

The pan-European STOXX 600 rose 2.0%, but clocked a weekly decline of 2%.

Data showed U.S. employers hired more workers than expected in August, but moderate wage growth and a rise in the unemployment rate could ease pressure on the Fed to deliver a third 75 basis point interest rate hike this month.

“If wage growth continues to moderate along with prices for goods and services the Fed may find a window to ease back on the pace of hiking, an event that would surely set up a relief rally in equities,” said Peter Essele, head of portfolio management at Commonwealth Financial Network.

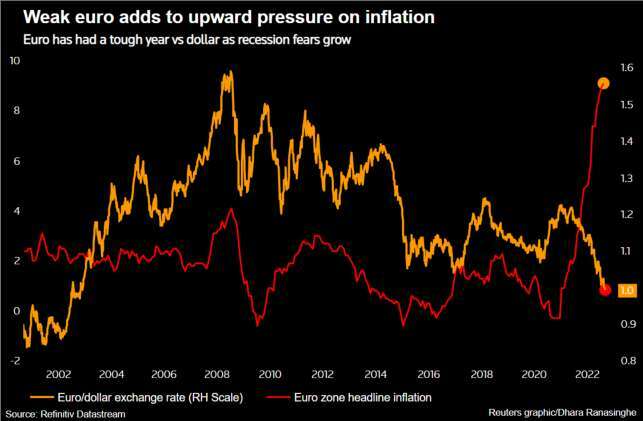

Investors sharply raised bets this week on a large 75 bps rate hike from the European Central Bank at its meeting next Thursday following hawkish commentary from policymakers and another record high inflation print in August. [GVD/EUR]

Money markets priced in an 80% chance of a 75 bps hike at the meeting, compared with less than 50% last Friday, per Refinitiv data.

Flows of Russian gas via the Nord Stream 1 pipeline to Germany remained at zero on Friday morning after Russia’s Gazprom halted supplies for a three-day maintenance outage on Aug. 31.

“I think the global economy, especially the European economy, remains hostage to what Russia decides to do with gas flows, at least for this coming winter. We just have to brace for more potential trouble coming that way from Russia,” said Andrea Cicione, head of strategy at TS Lombard based in London.

Credit Suisse rose 6.1% following reports that Switzerland’s second-biggest bank is considering cutting around 5,000 jobs in a cost-reduction drive.

Ryanair firmed 2.0% as the Irish low-cost carrier saw a record number of passengers in August for the fourth straight month.

Philips slumped to its lowest level since July 2012 after a subsidiary of the Dutch medical device maker agreed to pay more than $24 million to resolve alleged false claims over respiratory-related medical equipment, the U.S. Justice Department said.

Lacklustre August sales by Volvo Cars pushed shares of the Swedish automaker down 1.9%.

Miners fell the most, shedding more than 6% this week as metals’ prices dropped on renewed concerns that China’s zero-tolerance COVID-19 policy and rate hikes would dent demand for commodities. [MET/L]

(Reporting by Anisha Sircar and Shreyashi Sanyal in Bengaluru; Additional reporting by Shashwat Chauhan; Editing by Sherry Jacob-Phillips and Mike Harrison)