By Swati Verma

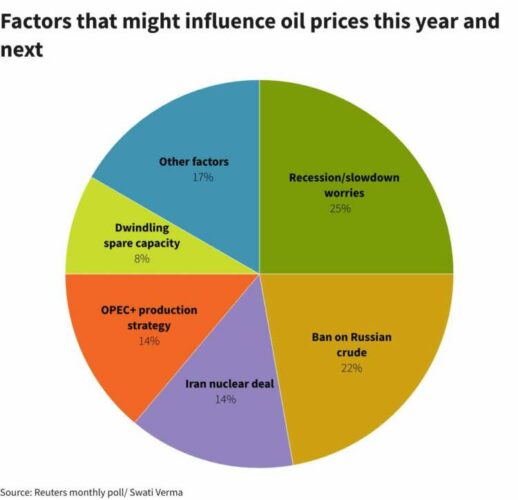

(Reuters) – A looming EU embargo on Russian oil is expected to exacerbate supply tightness and keep prices in triple digits this year unless there is a return of Iranian barrels, a Reuters poll showed on Wednesday.

A survey of 41 economists and analysts forecast benchmark Brent crude would average $103.93 a barrel this year, down from a forecast of $105.75 in July but above its current $100 trading level.

U.S. crude was seen averaging $99.91 a barrel in 2022, down from a July consensus of $101.28.

Oil prices have come off highs in March of nearly $140 on recession fears, but concerns about supply remain at the forefront, analysts said.

Fundamentals point to higher prices, with spare capacity below 2 million barrels per day (mbpd), oil inventories at multi-year lows and the European Union set to sanction Russian oil via shipping in December, said UBS analyst Giovanni Staunovo.

“Also, ending sales from the strategic oil reserves of OECD countries will remove more than 1 mbpd of supply from November, pointing to tighter markets at the end of the year.”

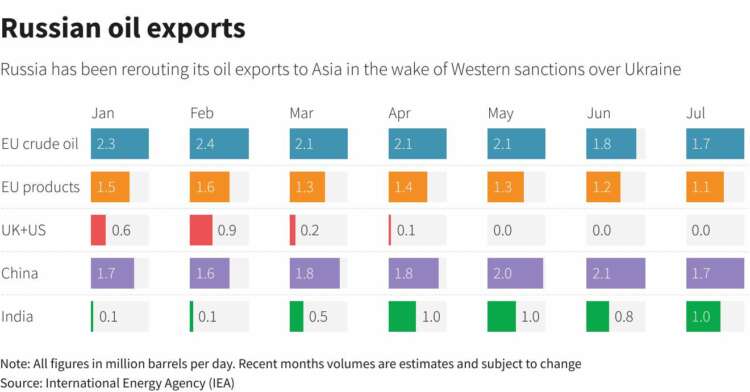

Most buyers have been cutting back on imports of Russian oil products since Moscow’s invasion of Ukraine, with the EU sanctions due to tighten later this year and a full ban agreed from February 2023.

“However, if and when the market realises that Russia is still able to shift exports to other regions, oil prices will retreat,” said John Paisie, president of Stratas Advisors.

Russia’s supplies to Asia as well as to some African states are growing, as buyers snap up discounted oil shunned by Western countries.

(Graphic: Russian oil exports Russian oil exports, https://graphics.reuters.com/OIL-PRICES/POLL/dwpkrxgrwvm/chart.png)

Low spare production capacity leave little option for raising output, said Carsten Fritsch, senior commodity analyst at Commerzbank.

Top oil exporter Saudi Arabia last week said that the OPEC+ group of oil-producing nations may need to reduce output to balance the market, leaving traders anxious ahead the group’s meeting on Sept. 5.

“The wild card is Iran nuclear deal, but it will likely have a knee jerk reaction on oil price rather than a sustained one,” said DBS Bank analyst Suvro Sarkar.

Iran has received Washington’s response to an EU-drafted final offer for saving Tehran’s 2015 nuclear deal with major powers.

If the deal is implemented, analysts see Iran adding as much as 2 million bpd to the market in 6-12 months.

(Graphic: Factors that might influence oil prices this year and next, https://graphics.reuters.com/OIL-PRICES/POLL/zjpqkrqjrpx/chart.png)

(Reporting by Swati Verma in Bengaluru; editing by Noah Browning and Jason Neely)