By Victoria Klesty

OSLO (Reuters) – Norway’s $1.2 trillion wealth fund, one of the world’s largest investors, said on Tuesday it would push the companies it invests in to cut their greenhouse gas emissions to net zero by 2050, in line with the Paris Agreement.

Institutional investors are increasingly looking to reduce the role they play in global warming through their investments, with Norway’s move coming ahead of the next round of global climate talks in Egypt in November.

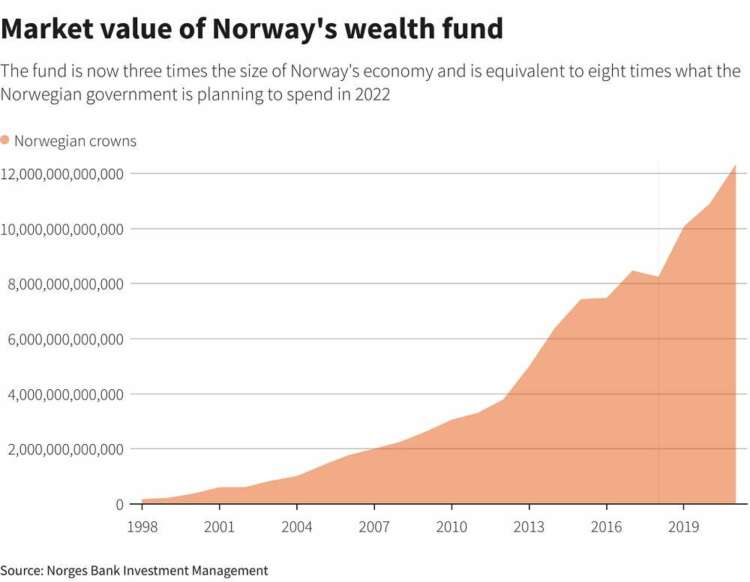

The fund invests the revenue from Western Europe’s biggest oil and gas producer for future generations in stocks, bonds, property and renewable projects abroad. It owns on average 1.3% of all listed global stocks and its holdings equate to $219,000 for every Norwegian man, woman and child.

Under the new plan, the fund will prioritise dialogue with the 174 companies that are the biggest emitters of greenhouse gases and account for 70% of the fund’s emissions via its shareholdings.

“They will be the priority,” fund CEO Nicolai Tangen told Reuters. “So more frequent follow-ups, and more specific follow-up. They will see more pressure from us than other companies.”

The fund has engaged with the companies it invests in on climate change for over a decade by, for instance, setting out its expectations as a shareholder on climate change.

Tuesday’s plan follows a proposal made in April by the government, which said the fund should push the 9,300 companies it invests in to cut their net emissions to zero by 2050.

Still, the fund reiterated it would not divest from big emitters to achieve these targets. Instead, it will be an “active shareholder” to effect change.

“The easy way to cut down emissions is to sell out,” Tangen told a news conference. “But someone needs to own these companies and it does not solve the problem, quite the contrary.”

All companies the fund invests in will need to have a plan to cut emissions to net zero by 2050. As of now, only 10% of the companies in the fund’s portfolio had a credible plan, representing 38% of the fund’s value, it said.

The fund will not publicly name the worst offenders.

“To name and shame you need to be very sure and certain, and you need, in my mind, to have audited numbers and evidence,” Tangen said.

The fund will likely be more active in voting against whole boards, and also become active in making shareholder proposals, though details of what they could look like “remains to be seen”, he added.

As a last resort, the fund could sell out of a company if it saw no evidence of it moving in the desired direction.

“It will take a little bit of time, you have to give them the opportunity to react,” said Tangen.

(Reporting by Victoria Klesty Editing by Jason Neely and Mark Potter)