- Over 12,000 companies’ insolvent this quarter – four times last quarter

- Multiple headwinds (rising interest rates, higher energy prices, cost and labour inflation and the removal of most government emergency support schemes) are putting pressure on businesses ability to make repayments

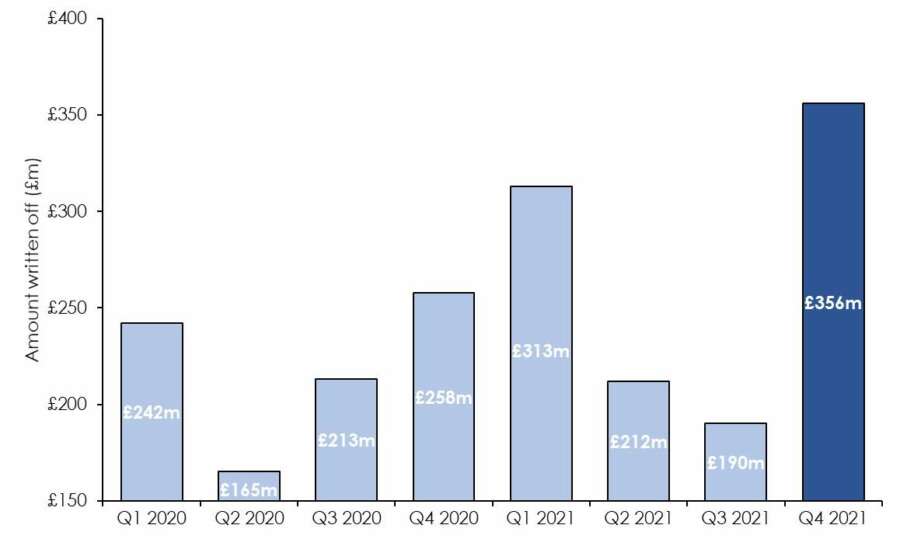

Value of business loans written off by banks rises to £356m in last quarter

The value of UK business loans written off by banks nearly doubled in the last quarter of 2021, rising 87% from £190m in the third quarter to £356m in the fourth quarter*, says ACP Altenburg Advisory (“Altenburg”), the debt advisory specialists.

Altenburg explains that write offs of loans have been subdued throughout the COVID crisis but are now rising as businesses have struggled with factors such as rising energy prices and the impact of rising interest rates.

The end of Government backed lending schemes such as CBILS and BBLS has also made it harder for businesses to roll over or refinance loans that are maturing.

Altenburg adds that not only do businesses face rising costs but also intense uncertainty over the situation in Ukraine and the lifting of restrictions on commercial landlords’ rights from the start of April.

Dan Barrett, Partner at Altenburg, says: “With an increasing number of headwinds in the economy, businesses will need to start contingency planning around their finances and what impact increased costs and/or interest rates will have. Without Government guarantees SMEs will find it harder to get bank finance and will have to look more closely at alternative finance providers.”

The rise in business loans being written off comes as 12,634 companies went insolvent in the last quarter of 2021, nearly four times as many as the previous quarter (3,471)**.

As business profits suffer from cost inflation more will be in danger of breaching the terms of their loan agreements, where those covenants are based on the profitability of that business. A breach of covenants may lead to a lender demanding repayment before the agreed maturity date.

Dan Barrett adds: “Businesses need to talk to their banks as early as possible if they think there’s a possibility they may breach any of the covenants of their agreement.”

Altenburg says it is not only businesses with outstanding debt who could be impacted by the UK’s economic downturn. Those looking to borrow will need to be aware that banks are now starting to undertake more stress testing on new borrowers to ensure that the businesses can afford repayments under higher costs and/or higher interest rates scenarios.

Previously stress tests would have typically assumed a 2% per year increase in a business’s cost base, but now many tests are assuming a 5% increase or higher.

As discussed in a previous article, businesses may want to consider hedging against interest rate rises. Interest rate swaps are one of the most used options for interest rate hedging, with around 90% of interest rate hedges entered into with UK banks using swaps.

Dan Barrett adds: “The unstable economic climate in the UK and cloudy outlook means businesses will need to be careful when assessing their funding options. Those looking to refinance debt or acquire new funding will need to ensure they get the right advice and correct information on their options, so they can find a funding solution that best suits their needs.”