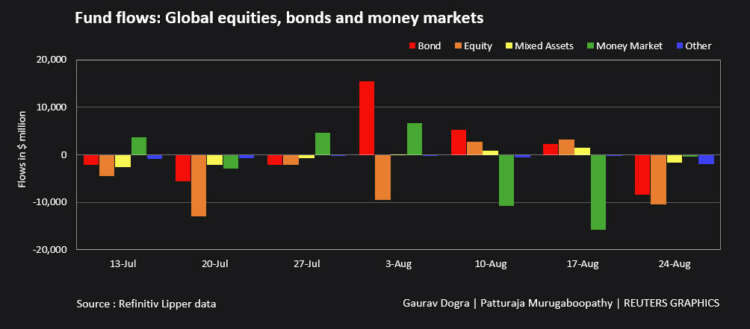

(Reuters) – Global equity funds witnessed their biggest weekly capital withdrawals in five weeks in the week to Aug. 24 on concerns that rate hikes would lead to a recession.

Investors were also wary ahead of the Federal Reserve’s annual Jackson Hole symposium, which could offer insights into the central bank’s future policy path.

According to Refinitiv Lipper, investors disposed of a net $10.48 billion worth of global equity funds in the week, which compares with just $3.15 billion worth of purchases in the previous week.

Fund flows: Global equities bonds and money market https://fingfx.thomsonreuters.com/gfx/mkt/zjpqkbrkmpx/Fund%20flows-%20Global%20equities%20bonds%20and%20money%20market.jpg

Fed Chair Jerome Powell is due to deliver his keynote speech to the symposium on Friday, and investors are likely to scrutinize the comments for any indication on how steep future interest rate hikes would be.

All major regions witnessed equity fund outflows with investors exiting a net $5.17 billion, $2.19 billion and $2.11 billion from Europe, the United States and Asia, respectively.

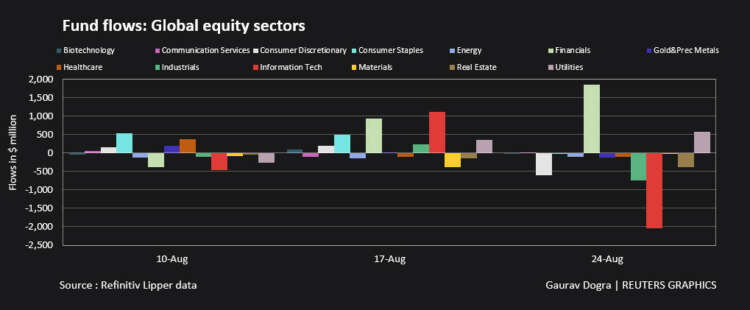

Among sector funds, tech, industrials and consumer discretionary faced outflows of $2.04 billion, $735 million and $595 million, respectively. Financials sector funds obtained $1.85 billion, while utilities received $588 million.

Fund flows: Global equity sector funds https://fingfx.thomsonreuters.com/gfx/mkt/xmpjomaoxvr/Fund%20flows-%20Global%20equity%20sector%20funds.jpg

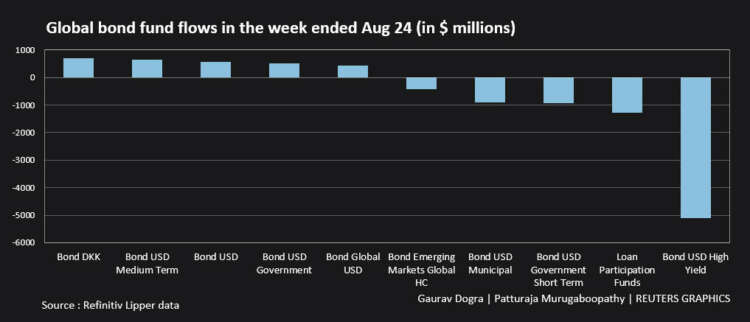

Bond funds also recorded withdrawals, amounting to $8.41 billion, the biggest for a week since June 29.

Investors sold high yield funds of $5.98 billion, marking their biggest weekly net selling since June 15, while government and short- & medium-term funds saw outflows of $894 million and $153 million, respectively.

Global bond fund flows in the week ended Aug 24 https://fingfx.thomsonreuters.com/gfx/mkt/zdpxozmomvx/Global%20bond%20fund%20flows%20in%20the%20week%20ended%20Aug%2024.jpg

Meanwhile, weekly net selling in money market funds eased to a three-week low of $375 million.

Commodities funds’ data showed precious metal funds suffered outflows of $354 million in a ninth straight week of net selling, while energy funds had a second weekly outgo, although a marginal $5 million.

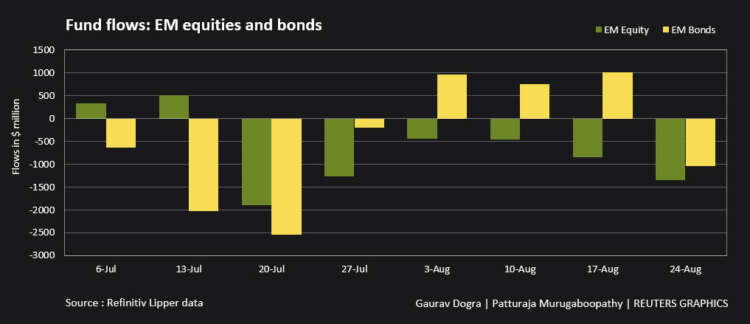

An analysis of 24,457 emerging market funds showed investors sold equity funds of $1.34 billion, posting the biggest outflow in five weeks, while also exiting bond funds to the tune of $1.05 billion, after three weeks of buying in a row.

Fund flows: EM equities and bonds https://fingfx.thomsonreuters.com/gfx/mkt/mopangengva/Fund%20flows-%20EM%20equities%20and%20bonds.jpg

(Reporting by Gaurav Dogra and Patturaja Murugaboopathy in Bengaluru; Editing by Kim Coghill)